In the future we likely going to need more things than we do today. There will be more of us, and we are going to be richer and consume more than our predecessors. It seems only reasonable that increased future demand should drive up commodity prices.

The earth is a finite system and contains finite resources. As time goes on, we extract the easiest and cheapest resources first leaving only the more difficult and expensive sources. Combining this with increased resource consumption and an increasing population and the argument for long run increases in prices becomes clear.

To aid in empiric ease and exactness I’ll look at copper and aluminum. These metals (especially copper) are sort of a barometer of global economic conditions and correlate strongly with economic growth. This makes them a good tool to examine the relationship between economic growth, resource demand, and commodity prices.

Copper Consumption

I did a Google Image Search for the term “Copper Consumption” this chart was the first result.

This is from the website of Canadian copper company AQM Copper[1]. The image shows the amount of copper demanded by the world between 1900 and 2007 as 608 Million tonnes. It estimates that over the next twenty-five years the world will use more copper than it has in the previous one-hundred and seven. AQM says that the surging demand is largely due to increases in urbanization and consumption in China. Similar growth can be seen in Aluminum[2].

This has been the story with copper (along with other commodities). Those in the business of producing copper have been quick to cite growing demand from an increasingly wealthy Chinese population, with additional boosts from other emerging markets, as a driver of increased commodity demand. So far, the story has been true. This is a microcosm of the question asked at the top of this post. Increases in the standard of living are indeed driving increased demand.

Cyclical Price Changes

The fact that the world is likely to need more metals in the future is hardly a secret. This is exactly what commodity traders and producers are looking at when they are trying to figure out the future price of metals. The people who are buying and selling metals are doing it with the full knowledge that consumption is increasing. They sell it at prices that they believe to be worthwhile after considering this information.

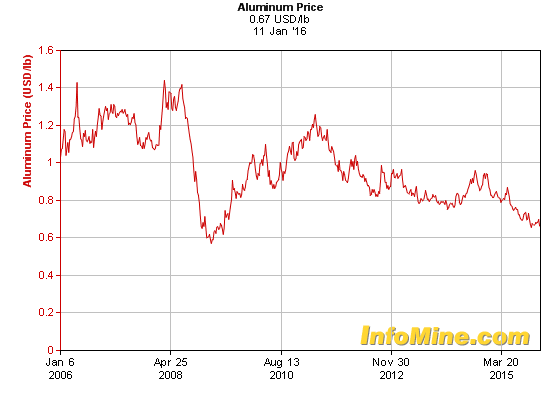

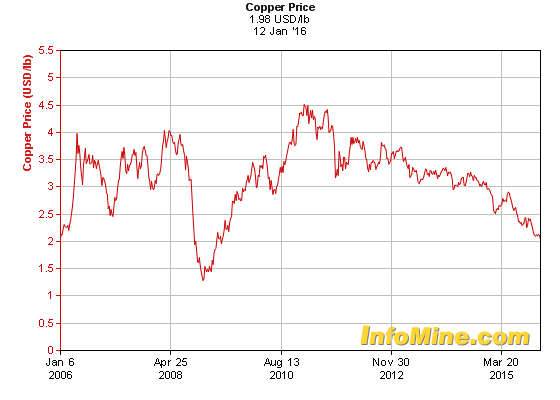

Despite increased demand, both aluminum and copper are worth about half of what they were five years ago. That’s a serious drop. aluminum is about 40 percent cheaper than it was ten years ago, which is also a significant drop.

After the financial crisis, many investors rushed into various commodities. Driven partially by the idea of surging demand from emerging markets, and partially by the fact that every other investment class seemed really scary at the time. They sort of overdid it, and there was a surge in copper, gold, and other commodities. Prices collapsed, bringing us to the current situation. We are currently on the downward side of a commodities cycle. Copper and aluminum had their recent peak about five years ago, and have been dropping ever since[3].

Price increases will inspire increased production, substituting, and recycling. At higher prices projects that were not viable at lower prices become worthwhile. For metals, this means mining more difficult to reach ore, as well as increased recycling and other methods of salvage. All of these factors help to counter the very price increases that spawned them. Both copper and aluminum production has increased over recent years.

This is the economist’s basic response to this question. As something get more expensive, people have greater reason to find more of it, find alternatives, and conserve what that they already have.

If rising prices increase production, falling prices should reduce it. This is true, but there are costs to starting and stopping operations. Mines are very expensive. A large proportion of their costs are the upfront costs of construction, surveying, satisfying regulatory agencies, and all the other costs of building a mine. Once a project has begun operations, it is likely to keep producing even if the price drops significantly. Therefore, while high prices might be enough to inspire increased production, low prices may not be able to stifle It in the short term. For the individual producer, the most profitable course of action during low prices might be to recoup as much of their investment as they can by producing as much as they can. These asymmetries help to create the pronounced cycles commonly seen in commodity prices.

Long Run Price Trends

Perhaps more importantly for the answer of this question is the long term trend of metal prices. Aluminum used to very expensive. It was considered a semiprecious metal in the late 1800s[4].

Both copper and aluminum prices fell during the first half of the 20th century. Since about 1950, the trend for Aluminum is down, and the trend for copper is mixed[5].

Several factors counter the long run rise of resource demand. Technological change, along with improvements in mining, leads to cheaper extraction of greater quantities. Metals, unlike other commodities such as corn or oil, stick around after being extracted. This allows for recycling, “urban mining” and selling scrap. The relationship between these forces and demand should determine long run price trends.

Just because the world will need more commodities in the future does not mean that those commodities will be more expensive now. Prices are determined by the intersection of supply and demand. Going forward, Technological improvement will make some commodities easier to produce, it will make others more important, and it may make others unnecessary. So far production has been able to keep up with demand, and current prices indicate that this trend is not expected to change in the near future.

[1] http://www.aqmcopper.com/s/copperfundamentals.asp

[2] See the first chart in this article. http://www.bloomberg.com/gadfly/articles/2016-01-12/alcoa-earnings-its-split-can-t-come-soon-enough

[3] Price charts from InfoMine.com. Obviously.

[4] http://minerals.usgs.gov/minerals/pubs/commodity/aluminum/050798.pdf

[5] The data for these four charts comes from the USGS This data only goes through 2013, both AL and CU prices have fallen since then.

So for the individual producer, in low-price time, who continues to produce as much as she can, is it better to sell for a lower price, or stockpile until the price increases?

LikeLike

Thanks for the question Monica!

I think producers (of metals at least) do not normally stockpile large amounts of what they produce. The costs of building and operating mines are high, and it may take a long (and deeply uncertain) amount of time for prices to increase. So sitting around and waiting for prices to increase becomes very expensive. I think these decisions regarding production and acceptable prices are made more toward the beginning of the process, when companies are trying to figure out if they should go ahead and build the mine in the first place.

-PSH

LikeLike